are nursing home expenses tax deductible in canada

You may claim 100 of the cost of your nursing home stay or long-term care facility if your DTC is approved by the. This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages.

Seniors Health Homes And Help From The Taxman Lawnow Magazine

How Much Of Nursing Home Care Is Tax Deductible.

. Only the portion of your monthly bill used to pay attendant care salaries can be deducted. When OHIP does not automatically cover a stay in a nursing home you can use it as a tax deduction. Can I deduct these expenses on my tax return.

Group homes in Canada. Group homes in Canada. Salaries and wages for attendant care given in Canada.

Can I deduct these expenses on my tax return. Yes in certain instances nursing home expenses are deductible medical. Are nursing home costs tax deductible irs.

Which nursing home costs are tax deducti. Attendant care costs including those paid to a nursing home can be used as medical expense deductions on your tax return. Are Long-Term Care Expenses Tax Deductible In Canada.

Can I deduct these. If you your spouse or your dependent is in a nursing home primarily for medical. Are Long-Term Care Expenses Tax Deductible In Canada.

To claim these expenses. Nursing home costs are tax deductible if the primary reason for residence in a nursing home is to receive medical care. Should he receive medical care while residing in the home you can claim those costs as a deductible expense along with any nursing services that might be provided.

The federal and Ontario governments have tax credits available to taxpayers including those paid for medical expenses. The attendant care costs can also be split between the disability supports deduction and medical expenses. You also need a completed Form T2201 from a.

You may need a prescription for special shoes or inserts to. 376 Amount for a. Nursing home expenses are fully tax deductible when the patient is in a home out of medical necessity.

Retirement homes homes for seniors or other institutions that typically provide part-time attendant care. The size of your METC will depend on your eligible expenses your net income for the tax year and the. It is non-refundable but may be subtracted from the taxes you owe.

It is non-refundable but may be subtracted from the taxes you owe. For seniors who are eligible to claim the disability amount attendant care expenses paid to a retirement home may be claimed as a medical expense. As medical expenses the cost of qualified long-term care may be deducted if unlike other healthcare expenditures it.

You must first complete your Form 1040 through line 38 which gives your. You need to include a detailed statement of the nursing home costs. This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages.

Medical expenses are computed on lines one through four of the Form 1040 Schedule A. This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages. Yes in certain instances nursing home expenses are deductible medical expenses.

Nursing homes special rules apply to this type of. The Medical Expense Tax Credit METC can be. Salaries and wages for attendant care given in Canada.

Is a nursing home tax deductible. Yes in certain instances nursing home expenses are deductible. Salaries and wages for attendant care given in Canada.

Nursing Home Expenses Income Tax Act s.

Top 5 Work From Home Nurse Jobs Making It Pay To Stay Nursing Jobs Working From Home Hospital Jobs

How To Claim Rent On Taxes In 2022 Filing Taxes

Claim Cra Allowable Medical Expenses In Canada Homeequity Bank

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

Claiming Attendant Home Care Expenses All About Seniors

Claiming Attendant Home Care Expenses All About Seniors

The Top 9 Tax Deductions For Individuals In Canada

What Medical Expenses Can I Claim On My Taxes In Canada

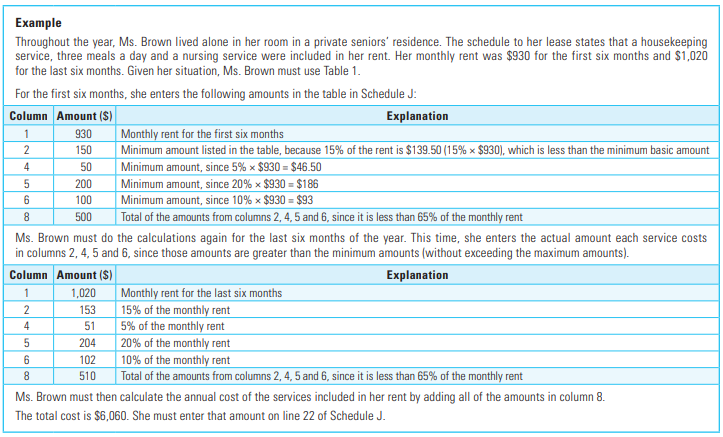

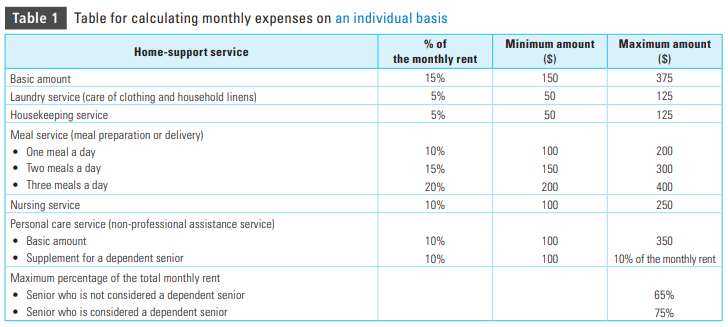

Dt Max Line 458 Tax Credit For Home Support Services For Seniors

What Qualifies As Medical Expenses When Filing Taxes 2022 Turbotax Canada Tips

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

It S Tax Time Important Information For Seniors To Consider

Medical Expenses And Taxes What Can You Claim Filing Taxes

How To Deduct Your Medical Expenses 2022 Turbotax Canada Tips

Rental Property Management Template Long Term Rentals Rental Etsy Rental Property Management Rental Property Property Management

Tax Deductible Medical Expenses In Canada Groupenroll Ca

Top 5 Work From Home Nurse Jobs Making It Pay To Stay Nursing Jobs Working From Home Hospital Jobs

Dt Max Line 458 Tax Credit For Home Support Services For Seniors